Leveraging Data & Analytics to Improve Customer Experience

We are deeply embedded into the age of the customer, and the key to survival is data-driven and insights-driven customer obsession. Forrester’s research shows that positive customer experience (CX) correlates to greater increases in revenue and profitability. In February 2017, Dun & Bradstreet commissioned Forrester Consulting to evaluate how enterprises are leveraging data and analytics to drive decisions and strategy in pursuit of customer obsession and the role the CFO plays in achieving that goal. Forrester conducted an online survey of 250 finance executives at organizations with $150 million or more in revenue to explore this topic.

The study revealed distinct customer experience data strategy differences between the firms that merely have good customer experience intentions and those that translate customer strategies into favorable business results. As the strategic steward of business outcomes, the CFO has a considerable stake in their organization’s client obsession efforts. Given the strong link between improved customer strategy and business results, it is critical for CFOs to take an active role in leading their organizations from customer-focused to customer-obsessed.

Key Findings of the Customer Obsessed Finance Leader Study:

- CFOs have an important role to play in the pursuit of data-inspired customer obsession.

- CFOs need a new data-inspired operating model to understand and overcome barriers.

- Customer obsession and CX strategy require mastery of seven key data maturity and competency factors.

- An investment in data allows for actionable insights.

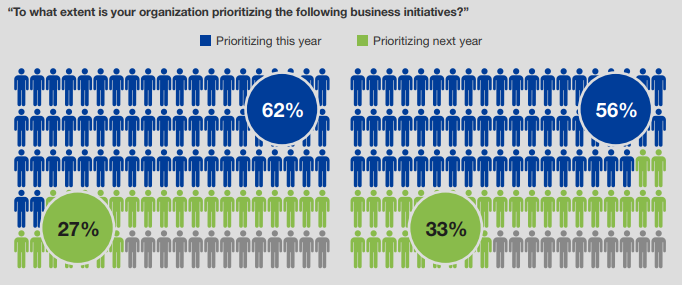

Of the 250 finance executives surveyed, nearly all organizations are prioritizing improving customer experience or addressing rising customer expectations either in the near term or next year. But this transformation can be a challenge for many organizations, impeded by disconnected strategies, innovations, and technology investments.

Finance Leaders Must Become Customer Obsessed.

Six years into the age of the customer, and the edict to today’s enterprises is clear: Put customers at the center of your strategy and operations or risk losing ground to competitors.1 Indeed, our survey of 250 finance executives revealed that nearly all organizations are prioritizing improving customer experience or addressing rising customer expectations either in the near term or next year (see Figure 1). But this transformation can be a challenge for many organizations, impeded by disconnected strategies, innovations, and technology investments. The key to success? Organizations must go beyond customer focused and become customer obsessed. A customer-obsessed enterprise relentlessly focuses its strategy, operations, and budget to enhance its knowledge of and engagement with customers.

The key to success? Organizations must go beyond customer focused and use analytics and data become customer obsessed. A customer-obsessed enterprise relentlessly focuses its strategy, operations, and budget to enhance its knowledge of and engagement with customers.

This image illustrates the answers of 250 CFOs and EVP familiar with their organization’s use of data/analytics to inform decisions and strategy.

The ROI on Customer Obsession

Being truly customer obsessed is about intent and results. Forrester’s research shows that, across multiple industries, customer-obsessed firms experience higher rates of revenue growth.2 Even a modest improvement in customer experience can have a significant positive impact on revenue

CFOs have an important role to play in the pursuit of data-inspired customer obsession.

As the strategic steward of cash flow, revenue, and profitability, the CFO has a substantial stake in the organization’s customer obsession efforts, as the link between customer strategy and business results is tangible. Thus, CFOs need to take an active role in leading their organizations from customer focused to customer obsessed. Today, 53% of the finance leaders surveyed reported they were responsible or accountable for their organization’s customer-focused initiatives. This marks a significant shift in the CFO role, from managing finance, risk, and compliance to partnering over customer strategies. According to the finance leaders in our study, conversations with their executive peers are as focused on strategy and growth as on risk and operational efficiencies.

Customer Obsession Requires A Data-Driven Strategy

To succeed at customer obsession, organizations need to transform into a data-and insight-driven business. Forrester’s data shows that organizations driven by data and insights are 39% more likely to report year-over-year revenue growth of 15% or more.5 Further, we predict that insights-driven businesses will grow at least eight times faster between 2015 and 2020 than global GDP.

CFOs are uniquely positioned to drive the transformation to a data- and insights-driven organization. Among customer-obsessed Leaders, 78% of CFOs are extremely familiar with their organization’s use of data and analytics compared with just 54% of Followers.

Data Challenges Impede Customer Obsession

Transformation to a data-and insights-driven organization isn’t easy. Most firms have an overabundance of data but do a poor job of leveraging it for insights. The CFOs identified key obstacles to gaining insights from data:

- Disparate data. In order to win, serve, and retain customers, it’s critical to have a single view of the customer across all points of engagement. Yet, roughly one-third of CFOs reported that their ability to leverage data and analytics is hindered by a lack of data integration (35%) and difficulty in aggregating data from different sources (32%)

- Organizational silos. The data-driven decision-making process is multifaceted, informed by multiple sources of information. When departments are walled off, however, it’s nearly impossible to get the insights needed from business stakeholders to drive decisions and strategy — a challenge cited by 37% of CFOs.

- Lack of consistent metrics. Customer-obsessed firms align on key customer-centric metrics and take the actions that matter most on the insights they derive from data. To achieve this, it’s critical to capture the key performance indicators (KPIs) that stakeholders are looking to influence and that will provide proof of success. However, if stakeholders are not clear on the KPIs they are seeking to improve, this is a red flag. Twenty-two percent of finance executives surveyed cited disparate methods of calculating and looking at KPIs across the organization as an obstacle to getting actionable insights out of their data and analytics

Customer Obsessed Operating Models Must Be Data-Driven

Customer obsession changes the dynamics to capturing, analyzing, acting, and learning from customer insights. A new operating model emerges for the CFO, which includes:

- Executive engagement. The CFO must evaluate existing interaction and collaboration with executive peers in order to participate and help lead customer obsession.

- Strategic contribution. The CFO needs to rethink financial tracking and analytics capabilities to include insights and models that support and drive customer obsession results.

- Data strategy. CFOs will need to transition from traditional technology investment in data based on lower TCO to investments that drive topline customer-obsessed results.

- Data sourcing. CFOs must realize that harvesting data from trusted sources, such as private, partner, proprietary, and public data, is central to moving from customer-obsessed strategies that are based on perception to those that are based on fact.

- Data and analytic capabilities. CFOs will need to prioritize data and insight that better identifies and predicts opportunities, threats, and weaknesses to the customer strategy in the market and the competition.

CFOs Must Lead Customer Focussed Strategies with Alignment and Data Competencies

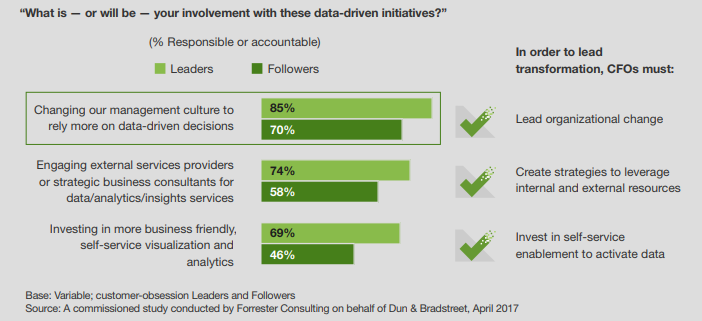

There is no quick fix to overcome these hurdles. Organizations must change from the inside out to become data-and insights-driven. To enable this transformation, CFOs must: › Lead organizational change. Leveraging data for insights that drive decisions and actions is a core competency of customer-obsessed Leaders. Eighty-five percent of CFOs at Leading organizations are responsible or accountable for changing their management culture to rely on more data-driven decisions, compared with 70% of Followers

- Lead organizational change. Leveraging data for insights that drive decisions and actions is a core competency of customer-obsessed Leaders. Eighty-five percent of CFOs at Leading organizations are responsible or accountable for changing their management culture to rely on more data-driven decisions, compared with 70% of Followers

- Invest in self-service enablement to activate data. Technologies supporting delivery of insights to internal stakeholders are critical to fueling decisions that lead to customer obsession. Sixty-nine percent of Leaders are taking the lead in making investments in more business-friendly, self-service visualization and analytics versus just 46% of Followers.

- Create strategies to leverage internal and external resources. Savvy CFOs know they need the right balance of internal and external expertise to manage data, convert it to insights, and contribute to business decisions that drive growth and customer obsession. Leading CFOs are looking beyond their organization for help: 74% of Leaders are responsible or accountable for engaging external providers or consultants for data, analytics, and insights services compared with 58% of Followers.

Of course, this transformation does not rest solely on the shoulders of the CFO. While 52% of the finance executives surveyed reported working most closely with their CEO to achieve the goals and objectives of their organization’s business priorities, developing a business case for data initiatives requires collaboration across the organization — beyond the executive suite. It’s critical to involve stakeholders across the business to gain a clear understanding of benefits, requirements, and KPIs, as well as to mitigate technology or organizational silos. While CFOs at Leading organizations share responsibility for building the business case for data- and analytics-driven initiatives with the CEO and CIO, executive, line-of-business, sales, and technology stakeholders also play important roles in the process.

Mastery Of Data Competencies is the Key to Success

The transformation to a data-driven, customer-obsessed organization requires more than having the right technologies, well-defined metrics, or even a clear strategy: Leaders in customer obsession exhibit mastery across seven key data maturity and competency factors.

In our survey, we established an assessment across these seven key areas (20 individual criteria). Finance executives reported on how well their organizations were executing on these criteria, from “needs improvement” to “very well.” This assessment revealed distinct differences between customer obsession Leaders and Followers in their performance across these key data competencies:

- Business alignment. Data and analytics investments are often viewed by business decision makers as a means to optimize resources and meet technology management objectives. However, these stakeholders also have expectations that these investments will have tangible outcomes, including improvements in customer experience and an increase in revenue. Successful business alignment hinges on having a clear data and analytics strategy that has cross-organizational support, is aligned with the organization’s business strategy and CFO priorities, and has clearly defined outcomes.

- Data governance. Data governance is both a process and an outcome. Effectiveness is contingent upon collaboration among technology management, data and analytics professionals, line-ofbusiness data owners, and executive management. Data governance programs must not only play a critical role in business operations and planning; information, insight, and sources need to be well understood, consistent, validated, and appropriately shared across the organization

- Data management leadership. Successful transformation to a customer-obsessed data-driven organization requires both business and data leadership. With the link between data-driven customer obsession and business outcomes, the CFO and chief data officer (CDO) should work in lockstep to set the necessary investment and data strategies.

- Data management process. As organizations become increasingly insights driven, data management will become more distributed. While some data management processes will remain centralized, collaboration across the organization will result in complex dependencies across business stakeholder requirements. It’s therefore critical that data management teams establish constant communication and collaboration with business units and other stakeholders. In doing so, organizations can better ensure that their data and insight processes meet strategic, project, and ad hoc needs for data and insight.

- Data management technology. We’ve already seen that developing the business case for data initiatives and investments needs to be a collaborative process, inclusive of executives as well as business and technology management stakeholders. But to succeed in the age of the customer and be truly data driven, organizations must continually evolve and invest in modern data and insight technology.

- Data insights and delivery. Data analysis and insights are of little use if those findings aren’t readily communicated or easily accessible to stakeholders. In order to glean actionable insights from your data, it’s critical to have data capabilities in place that make it easier to access and use data, including tools that aid with the sourcing, blending, cleansing, and sharing of data and insights.

- Measurement and metrics. It’s important to have clear goals and metrics in place to understand the value that data brings to the organization and continuously improve insights. Customer-obsessed organizations see measurable data-driven outcomes, including the creation of new revenue streams, efficiency improvements, and the development of customer-driven products and services.

Invest In Customer Data For The Right Outcomes

To stay competitive and become customer obsessed, firms must accelerate driving data to insights and, most important, take more actions from insights to improve business outcomes. Having the right data investment strategy is critical to success.

Budget for customer obsession. There’s no silver-bullet technology that enables organizations to easily and automatically glean actionable insights from data. Rather, customer obsession requires continual investment in a variety of data and delivery platforms as well as analytics tools to remain competitive. Seventy-nine percent of customer-obsessed Leaders are making that financial commitment, predicting that their organization’s 2018 IT capital spending will increase over 2017, compared with just 57% of Followers.

Invest in technologies that drive customer obsession. Making customers the central point of your strategic decisions and discussions will establish a shared approach to technology investments. Coupling systems of engagement and systems of insight is critical to data-driven customer obsession and should be the cornerstone of your business technology agenda.8 Roughly eight out of 10 of Leaders reported they will increase spending on systems of engagement (79%) or systems of insight (86%) in 2018, compared with 55% and 65% of Followers, respectively

Key Recommendations for Customer Focussed Business Strategies

Customer obsession can start as a program in customer experience, marketing, or sales where tactical changes, improvements, and investments will move the needle incrementally. For firms to be competitive, customer obsession driven by data and insights competencies is a must to not only stay competitive but avoid future disruption. CFOs are in a unique position to see the big picture opportunity and impact of the customer-obsessed operating model to shape, grow, and transform their organizations with the proper investment, KPIs for success, and visibility into the market forces that will economically impact the firm’s objectives. To be a customer-obsessed CFO means:

- Leaning into the customer-obsessed conversation. The CFO must interact more directly and frequently with peers on financial strategies, plans, and results in context of customer objectives.

- Extending financial insights to include the wider customer experience. The CFO needs to lead the organization in defining those financial impact reports as well as macro strategic insights to support strategic customer planning.

- Investing in data to meet the demands of customer obsession. The CFO should orient investment evaluations toward reducing mounting technical debt from data while concurrently increasing spend on data systems to enable deeper insight.

- Avoiding internal bias and customer blind spots. CFOs must support and audit investments needed to acquire and ingest partner, third-party, and public data to augment and remove bias from internal system data and qualitative experience.

- Transforming the CFO dashboard to lead customer obsession. The CFO needs to expand the balance sheet and financial operations reporting with better economic models and predictive analytics that link customer strategies with forecasts and also identify external business opportunities and threats in the market.