Benefits of Automation in Finance

Finance leaders have come a long way from being bookkeepers and number crunchers; they’re now becoming guardians of data and proponents of digital transformation. As more businesses move away from reliance on manual processes and toward digitalization, department leaders are looking to financial process automation. This will give their teams the bandwidth and resources they need to move their organizations forward – leaving old preconceived notions (and their ledgers) in the past.

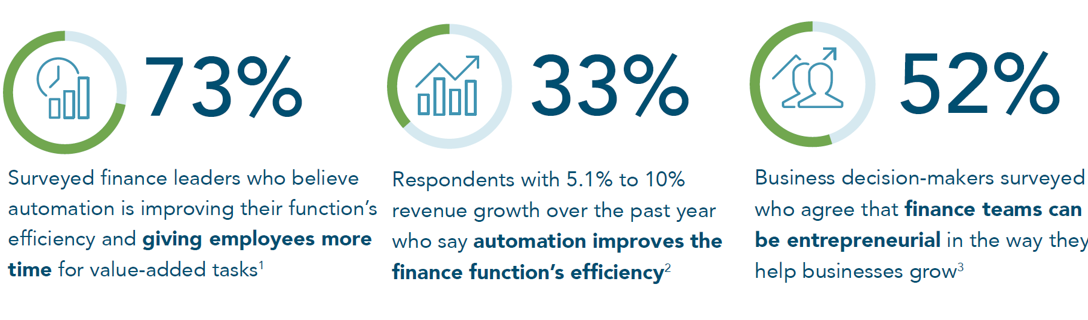

More Time for Strategic Initiatives

Taking the next step in financial department evolution means embracing the automation of routine accounting, administration, and compliance tasks to free up teams to deliver global operational efficiencies and help drive growth. With workflow automation, companies can reduce operational costs and shine a light on new avenues of growth by creating more time for strategic initiatives that drive value and profits.

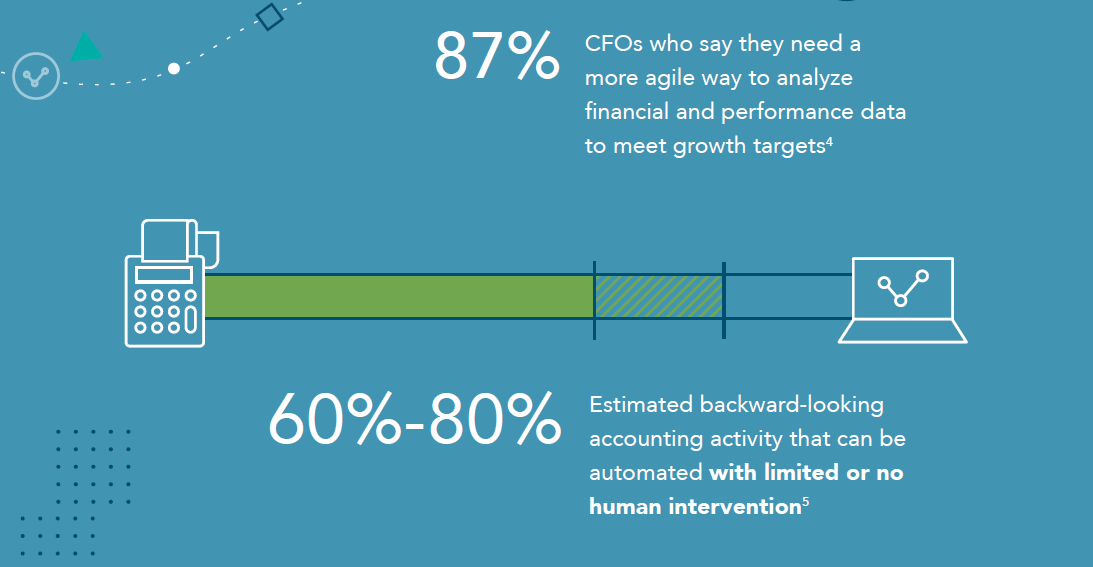

Automation Makes Sense of Data

Without automating some of the processes to gather and understand the wealth of data for decision-making, the ability to harness insights and act on them becomes nearly impossible.

More Finance Jobs — Not Fewer

According to Gartner, it is estimated that by 2020, artificial intelligence (AI) will become a positive net motivator, creating 2.3 million jobs. This should ease employee fears around automation job phase-out, paving the way for continued evolution in finance organizations. The future of finance is now, and it’s being embraced by the C-suite —making CFOs and finance leaders their most trusted source for data insights, cross-departmental collaboration, and strategic decision-making.

Embrace Workflow Automation Tools or Get Left Behind

Investing in the right tools and technology for financial process automation is one of the wisest moves a financial leader can make on the path to digital transformation. Today’s finance teams are at the forefront of guiding their companies toward profitable growth, solid financial stewardship, and effective risk management.

So, while managing modernization is a balance between moving forward or becoming stagnant, CFOs and their teams can lead companies effectively if given the responsibility. In fact, changing work practices within the “designated” finance department can generate a shift in technology that leads to improved efficiency and stronger strategic development throughout the entire company. Certainly, investing in tools and resources to automate key processes and free up resources for other tasks is among the most important decisions a finance leader can make.

Embrace Opportunity

In the end, the automation of finance not only brings a great deal of innovation, but also practical transformations that will continue to drive technological advancements right before our eyes. And that is something we can all invest in.

Click on the link below to check out the full Automation for Finance Teams infographic.