Understanding Country Risk Around the World

Despite a backdrop of uncertainty, 2018 was largely a good year for the global economy, with many countries seeing improved growth as well as strengthening labor market conditions and overall trade volumes. Last year, Dun & Bradstreet changed the Country Risk Rating1 of 25 countries - 18 upgrades and only seven downgrades. The best performer was Argentina, which saw its ranking improve by four quartiles. But as the country is now facing difficult challenges, it's unlikely that level of success can be repeated this year. Other top performers include Iceland, France, Japan, and Norway. Seven countries experienced a deteriorating Country Risk Rating, including Turkey and Germany, which lost its top spot to Norway.

While Dun & Bradstreet expects global real GDP growth to remain largely unchanged from the almost 3% we've seen in 2018, the composition will shift as most of the developed world, (including the US, China, and the Euro Zone) will shift into a lower gear this year. On the upside, some emerging markets (including India and Brazil) will see higher growth in 2019.

Real GDP Growth (%)

However, the biggest risk to the global economy in 2019 is the rise of populism and its impact on free trade.

The Rise of Populism and the Future of Free Trade

Populist and anti-establishment parties and candidates have performed well around the globe over the past years. In Europe, populist parties now hold around 25% of all seats in national parliaments and 170 million people are governed by populists (up from 12.5 million in 1998). In the US, both the Democrat and Republican parties have moved closer to the edges of the political spectrum, leading to a deeply divided political system that is increasingly unable to agree on compromises.

As a result, global free trade is increasingly under threat, potentially endangering supply chain risk. This could lead to higher prices for consumers and rising inflation rates. On the upside, several countries around the globe, especially those in Asia and in Europe, are still pursuing free trade negotiations. The EU and Japan have recently signed the Economic Partnership Agreement - the world's largest free trade agreement - and more talks are underway. It remains to be seen, however, how the China-US trade dispute will unfold as an escalation would have adverse effects on the global economy, given the size of the countries involved.

Country Risk Levels in the Americas

- Northern America: Increasing disharmony between the two major political parties in the US is translating into real economic consequences. After the longest partial government shutdown in US history, real economic activity will be reduced slightly in Q1 2019. With increasing politicization, the threat of federal government shutdowns will remain a business challenge.

- Latin America: A slowdown in Mexico arising from the recent fuel shortage crisis and recession in Argentina weigh on the region's near-term growth prospects, notwithstanding continued acceleration in Brazil. In addition, global trade tensions, rising protectionism, and lower growth projections for China are softening prices of regional export commodities.

Country Risk Levels in Western and Eastern Europe

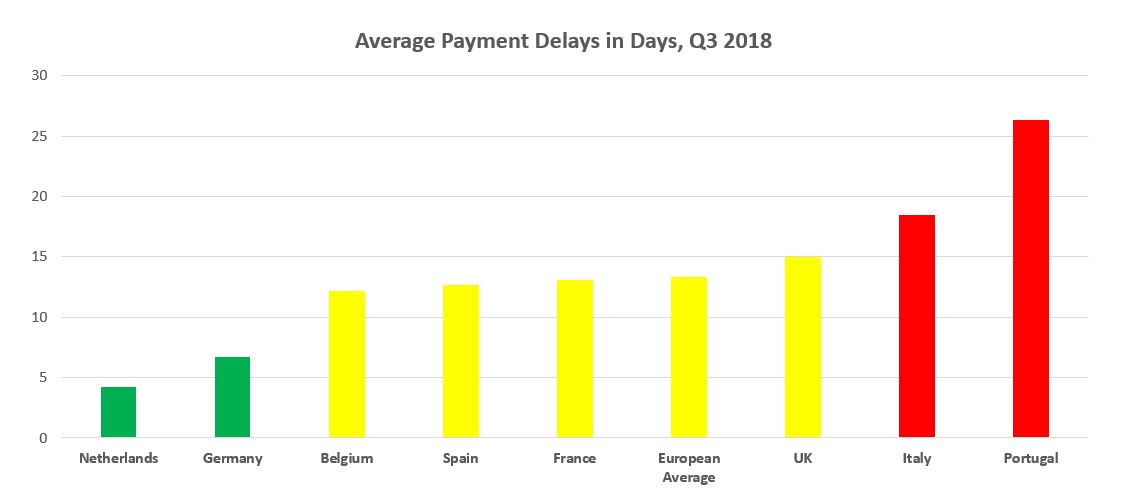

- Western and Central Europe: Real GDP growth data for Q4 shows that Italy has fallen into recession and that Germany, the region's biggest economy, avoided a similar fate by a whisker. Forward-looking indicators are still narrowly in growth territory, but economic headwinds are increasing. Meanwhile, proprietary payments performance information (see chart below) continues to show significant differences in B2B payment patterns. Average delays in Q3 2018 ranged from below six days in the Netherlands to around 26 days in Portugal.

- Eastern Europe & Central Asia: Negative headwinds from a global slowdown have filtered into the region, restraining the environment for trade as industrial production figures in Q4 2018 showed broad weakness. Our regional outlook trend is held at "deteriorating," which largely reflects ongoing Western sanctions, lower oil prices, FX volatility, and weaker production.

Dun & Bradstreet Payment Data Shows Significant Differences

Country Risk Levels in Asia Pacific and the Middle East & North Africa

- Asia-Pacific: Higher-income countries with advanced manufacturing may be the most immediately exposed to China's weak economy in 2019. Exports to China from Singapore, South Korea, Taiwan Region, and Japan all contracted year-over-year in Q4. Our downgrade of China''s Country Risk Rating from DB4b to DB4c, meanwhile, reflected not only the Sino-US trade war but also domestic debt burdens.

- Middle East & North Africa (MENA): The rebound in oil prices to above USD60/b will help regional growth prospects, particularly in the oil-exporting countries. However, continued regional insecurity and still-high barriers to doing business, ensure growth will remain muted across the region. Furthermore, risks to our forecasts remain on the downside.

Free Global Outlook Report

Dun & Bradstreet's Global Outlook report provides a monthly high-level overview of key global developments to keep you informed on the risks and opportunities affecting cross-border business. Typically reserved for subscribers of D&B's Country Insight Solutions, the March 2019 Global Outlook report is available free of charge.

1 D&B's proprietary Country Risk Ratings provide a comparative, cross-border assessment of the risk of doing business in a country and encapsulates the risk that countrywide factors pose to the predictability of export payments and investment returns over two years.