Uncertain times for the Irish Economy

According to the World Economic Forum's Global Competitiveness Report 2019, Ireland is the world's 24th most competitive economy (out of 141 countries surveyed).

The economic damage caused by the current lockdown in Ireland is likely to be immense. Large parts of the economy, including hospitality, leisure, entertainment, retail (except supermarkets) and transport are now closed, while other sectors - such as manufacturing are suffering from supply chain disruption and a lack of workers as schools are shut. Taking all factors into account, Dun & Bradstreet is lowering its real GDP growth forecast for 2020. While a recovery in the second half of 2020 and in 2021 seems likely, the magnitude of this will largely depend on the success of the global containment efforts. Either way, Ireland will almost certainly enter a technical recession in Q2 2020, and real GDP growth for the year as a whole is likely to be worse than during the financial crisis.

Reacting to the Economic Impact of Coronavirus

Business leaders and economists had long been pondering the timing of the next recession and its most likely triggers. Unfortunately, no-one could predict nor prepare for the destructive capacity of the coronavirus (COVID-19) pandemic: exogenous factors such as epidemics/pandemics are difficult to model or control – you can only respond as best you can.

In response to the virus outbreak, the central banks of the US, the euro zone, and the UK were quick to take action, lowering short-term interest rates and or increasing the size of their Quantitative Easing programmes. After two weeks, as evidence mounted that the crisis was snowballing, authorities in the world’s largest economies announced stimulus packages. Even with governments ready to infuse billions to trillions into their economies, the overall uncertainty is driving volatility in the major equity exchanges worldwide and there is a real risk of rising unemployment and business failures.

Correlation Between Recessions and Bankruptcies

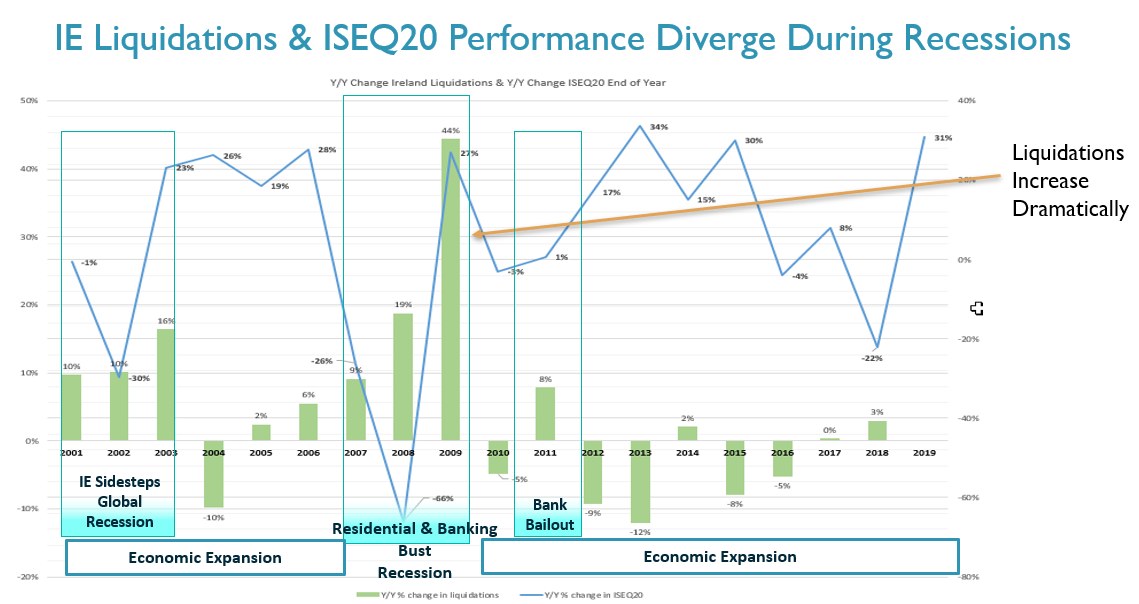

Dun & Bradstreet is tracking these developments in the world economy very closely. Our analysis shows seven years of significant increases in Irish liquidations since 2001: six of these increases are directly related to economic cycles/recessions, while the other one maybe related to the bank bailout:

The 2001-02 Recession & 2008 - 09 Ireland Residential/Banking Bust Recession

- Up until 2000 the Irish economy was characterized as the "Celtic Tiger" led by exports and low inflation. After 2000 Ireland attracted foreign investment by lowering corporate tax from 32% to 12.5% and the economy shifted to a rapid growth - construction & property economy (which may have sustained Ireland during the 2002 global recession).

- The Irish economy managed to maintain GDP growth during the world-wide recession of 2001 - 2002. However, in 2002, Ireland year-over-year liquidations increased by +10% (+16% in 2003) and the FTSE100 dropped by -30%.

- The Irish real estate price boom peaked in late 2006, the construction boom ended as real estate prices dropped. The world-wide banking bust worsened the Irish economic prospects sending Y/Y business liquidations soring by 9%, 19% and 44% in 2007, 2008 and 2009 respectively.

The Bank Bailout of 2011

- Business liquidations look to have spiked by 8% in 2011 following the shoring up of Ireland's banks through the financial crisis of 2008 punctuated by the 2010 €20B bailout of the Anglo Irish Bank.

"Central banks are taking strong actions to counter the impact of coronavirus. These precautions could help financially-secure companies that require a short-term liquidity solution, but, as we saw in 2008, companies in a weak financial state are at an increased risk of failure and could fail. Given 10+ years of expansionary business creation and low bankruptcy rates, we are concerned that an economic downturn could result in an unprecedented number of liquidations," Markus Kuger, Chief Economist for Dun & Bradstreet, said.

How to Prepare for Potential Impacts to Global Business Credit

I’m advising my finance and credit clients to re-evaluate their company’s credit policies to ensure they are:

- Onboarding an Appropriate Balance of Risk – Reassess your company’s credit policy to recalibrate the portfolio risk profile for new and existing customers to an approach that is more appropriate for a recessionary economy.

- Setting Proper Credit Limits – Use this opportunity to realign credit limits. Make sure they are informed by the credit exposure you have for the entire global corporate hierarchy for that customer. Consider adjusting credit limits (up and down) based on the individual risk assessment of that customer.

- Establishing Appropriate Credit Terms and Conditions – Evaluating the potential risk of each new opportunity or customer renewal will help realign your credit terms based on the probability the customer will pay on time and within terms.

- Monitoring Portfolio Risk – Perhaps more urgently, consider deploying credit risk monitoring of the entire global portfolio to pick up on pockets of weakness that could result in bad debt losses from potential bankruptcies.

There are opportunities in every economic situation. Many companies may need to quickly acknowledge that bad debt losses have been muted over the past 10 years. We could be entering a new economic reality that requires a more active approach to credit risk mitigation.

Let Dun & Bradstreet help you understand the hidden risk in your customer portfolio through the D&B Customer Risk Health Scan. This complimentary report identifies which of your customers are in geographies, industries or corporate families that are significantly impacted by coronavirus, or were already showing signs of financial stress prior to the outbreak.