Insolvencies and liquidations are at their highest level for a decade. But where are they headed?

UK businesses continue to grapple with a multitude of issues many of which ensued from the COVID pandemic, but also more recently from added geo-political tensions further stifling the economy. It is within this backdrop that businesses will be acutely focused on their own survival, and insolvencies & liquidations will be one of many signals that they will be following closely. Firstly, to gauge if things are worsening or improving but also, to understand how much longer they will need to operate at such demanding levels because of these heightened risks.

Where are Insolvencies & Liquidations headed?

Our latest data shows there were 6,862 insolvencies and liquidations reported in the last quarter of 2022 (see below chart). These are the highest quarterly numbers reported for over a decade. It was only during the peak of the global financial crisis in 2009, that numbers have been higher this millennium. This sharply brings into focus the severity of the current economic situation and the impact on businesses. However, the question in many business owners’ minds is, will these numbers worsen, and when will we turn a corner?

Based on these figures alone (not to mention the potential further surprises expected in 2023) it is difficult to determine if insolvencies have peaked or not. However, there are levels of data below this that could provide some directional insight.

One of the most common precursors to a business failing is its inability to meet debt obligations. Reviewing financials on an annual basis for this purpose, whilst accurate, may not be particularly timely. Fortunately, there are a few data sources that can provide insight in a much timelier manner.

Commercial Trade Payments – Trade payment information provides insight into payment & credit terms for businesses in a variety of industries, from manufacturers to professional services. It is an established and powerful source of insight. Join our Trade Exchange Program.

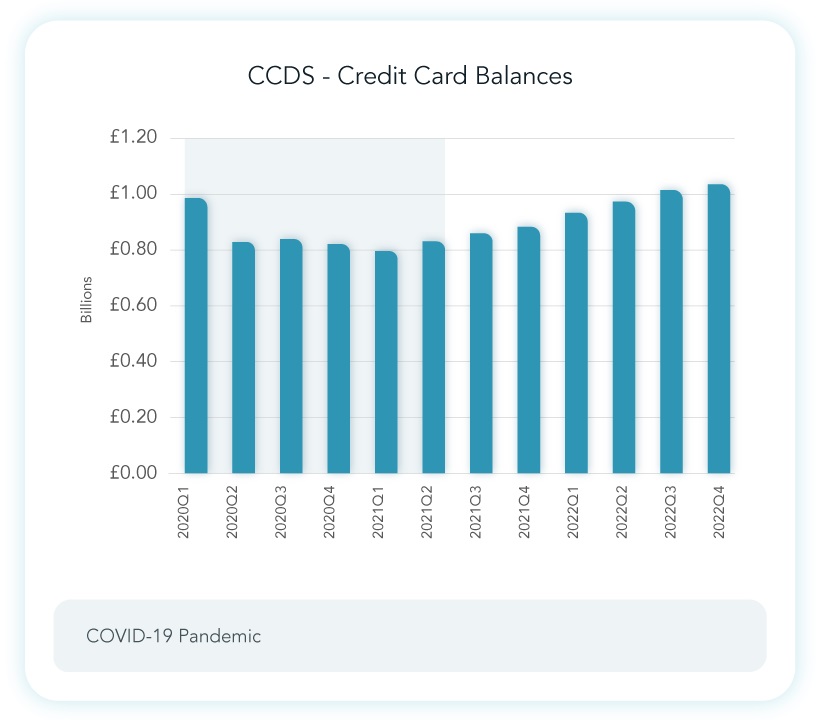

Commercial Credit Data Sharing – Commercial Credit Data Sharing (CCDS) is a more recent UK Government mandated initiative to encourage competition between lenders, through the sharing of commercial current accounts, loans, and revolving credit from designated banks. As a designated Credit Reference Agency (CRA), Dun & Bradstreet can provide banking CCDS data to UK financial institutions to help them make robust data driven decisions.

Commercial Trade Payments - What insight can be drawn from this data?

“More than 90% of businesses that fail exhibit a slow-down in payment to their suppliers six months prior to failure” Howard Trenam - Global Lead at Dun & Bradstreet, focusing on Payment Behaviour and Predictive Analytics.

Looking at trade payment performance over the past 4 years, the percentage of payments that are overdue by 3 months or more, increased from around 6% to almost double at 11.3% in Q2 2022 before softening towards the end of the year at 10.5%.

Interestingly this improvement in the last 2 quarters was driven predominantly from small businesses, which also account for almost 90% of all payments. This probably underlines the importance of trade credit to small firms, with medium to larger businesses providing slower payments possibly to retain cashflow without necessarily impacting their credit options.

CCDS Data – Are there similar trends?

Unsurprisingly, payment performance on lending products has also shown deterioration - and for loans in particular, there were some signs of softening towards the end of 2022. However, loan arrears have still increased significantly from the start of 2020 from 0.7% to 2.83%.

Credit card arrears are a little more erratic possibly due to flexibility in making minimum payments, however, credit card arrears and defaults are still increasing. There is also some evidence of balances building for credit cards, potentially storing problems for further down the line.

Directional, but also directive

The current trends are concerning, but more data points are needed to understand if we have turned the corner. This information, in combination with other data sources, can provide better insight at a macro level - but it is just as useful when assessing an individual business. Finance and credit managers can factor this data into their decision-making process or harness the power of data through leveraging D&B’s proprietary scores and models. This will provide the most optimal predictive and prescriptive analytics to support decisions for high-risk partners, suppliers, or customers. By effectively managing these relationships, businesses can avoid potential pitfalls – while ensuring they increase their own chances of survival.

We help businesses – large and small – to make smarter decisions. Browse our solutions that help you to know who to trust, how to manage risk, and where to find new opportunities.