Key Global Risks for Businesses

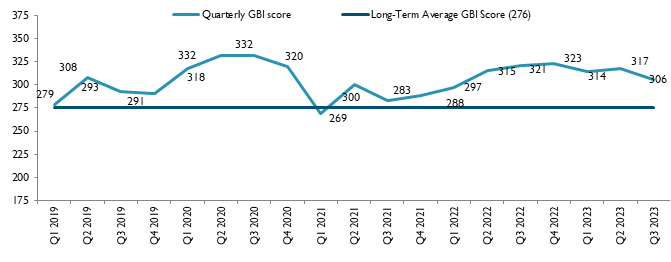

- The Dun & Bradstreet Global Business Impact score for Q3 2023 indicates that the risks confronting businesses remain high.

- The latest GBI score highlights that as economic risks seem benign, risks emanating from changes to the geopolitical order continue to pose a formidable challenge to cross-border business operations.

The Dun & Bradstreet Global Business Risk Report (GBRR) ranks the biggest threats to businesses. Based on its potential impact on companies, a score is assigned to each risk scenario. The scores from the top 10 risks are used to calculate an overall Global Business Impact (GBI) score.

Our latest GBI score declined to 306 in Q3 2023, following an overall improvement of the risk environment. Although the GBI score is at the lowest level in over a year, it is above the long-term average, indicating that the outlook for doing cross-border business remains challenging.

Global Business Impact Score

Source: Dun & Bradstreet

Methodology

Global Business Risk Environment: Improvement in Q3 2023

In Q3 2023, Dun & Bradstreet’s GBI score declined to 306, from 317 in Q2 2023 and significantly lower than the 2020 high of 332 recorded due to the effects of the pandemic. Although the GBI score is at the lowest level in over a year, it is above the long-term average of 274; businesses with cross-border operations continue to face high levels of uncertainty.

Our top 10 risks are based on the expertise of Dun & Bradstreet’s team of economists, who monitor 132 countries worldwide that account for over 99% of global GDP. They assess the key risk scenarios emanating from each region or pan-regionally. The GBI score of each risk scenario is calculated by combining an assessment of: (i) the magnitude of the scenario’s probable effect on the global business operating environment, on a scale of 1 to 5 (where 1 is the smallest impact and 5 is the largest); and (ii) the likelihood of the event(s) happening (out of 100). The maximum GBI score for each of the 10 risk scenarios is 100, so the upper limit for the overall GBI is 1,000. In the report, each risk scenario is categorized into a broad 'risk theme' for both the purpose of tracking and ease of presentation.

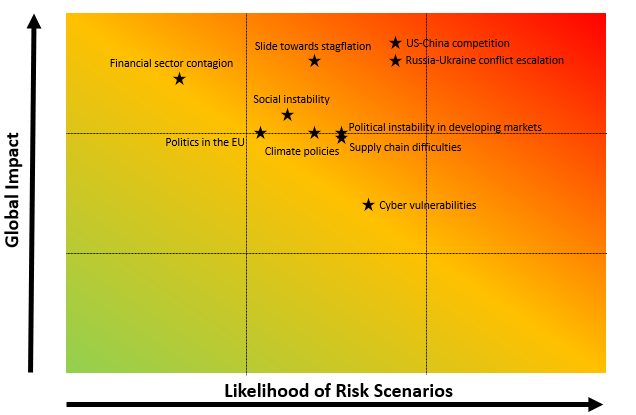

RISK OF A SLIDE TOWARD STAGFLATION AND THE GEOPOLITICAL CLIMATE ARE DOMINATING THE GLOBAL RISK ENVIRONMENT

In the Q2 2023 version of our GBRR, we highlighted U.S.-China competition as our top risk, assigning an incrementally higher likelihood to this risk scenario. In line with our expectations, the ‘chip war’ between the U.S. and Mainland China ramped up over Q2, despite diplomatic efforts to the contrary. This recurrent risk theme remains at the top of our risk radar for Q3 2023 as well.

Similarly, the Russia–Ukraine conflict, now past its 500-day mark, also retains its spot as a close second in our top risks for Q3 2023. Although there have been several developments – including the start of a Ukrainian counteroffensive, a further step towards the expansion of NATO, and Russia’s decision to pull out of the Black Sea Grain Initiative – the on-ground reality has barely changed. Since the outbreak of the conflict, losses have been piling up on both sides, and the conflict seems far from a resolution. A potential military escalation involving the use of higher-grade weapons or an inadvertent military accident involving a NATO member are also key risks worth monitoring.

On the economic front, the risk of stagflation has declined, though it remains among the top three risks for businesses to watch. Globally, inflation continues to fall, and the economies in North America and those of emerging markets in Asia Pacific and Latin America continue to hold up well, though those in the eurozone have experienced worsening prospects. Overall, the risk theme has seen a decline to both likelihood and impact.

Supply chain risks have seen a marginal increase in risk scenario likelihood for Q3 2023. While it is widely understood that traditional supply chain strains that peaked during and after the pandemic have, to a large degree, normalized, we are tracking a different set of risk scenarios under this risk theme. Among these, greater resource nationalism and geopolitically motivated controls and restrictions, such as China’s newly announced controls on two rare metals, have witnessed rising risk over the quarter.

After a gap of several quarters, ‘politics in the EU’ is now back in our top 10 risks to watch. Recent rioting in France, a government collapse in the Netherlands, and snap elections in Spain mean that European politics will begin to heat up in the run up to the European Parliament elections in 2024. Migrants, economic and climate policies, and relations with Russia and Mainland China will dominate the discourse.

At the same time, ‘political instability in developing markets’, which entered the list of top 10 risks in Q2 2023, has seen an increase in likelihood of its related risk scenarios. Thailand is dealing with a period of political uncertainty, as the leader of the party that won the most votes in the election was effectively ruled out of the premiership and the fate of the next government remains unsure. In Turkey, the incumbent victory in the May elections has been accompanied by policy U-turns, and Argentina is preparing for its own elections. And all this while, political instability in Africa has increased.

Top Ten Risk Themes

Source: Dun & Bradstreet

A closely related risk theme, ‘social instability’, which tracks the risk of civil unrest from cost of living and livelihood issues, has also seen a marginal uptick in likelihood. This is driven by the expectation of higher food prices due to geopolitical factors and weather-related events, including droughts and flooding, which are more likely to happen due to El Nino.

Two other risk themes – cyber vulnerabilities and climate policies – remain among the top 10 risks for Q3 2023, with no change in the likelihood or impact of risk scenarios tracked under these themes.

Banking systems seem to have absorbed the stress induced by the failure of regional banks in the U.S. and the folding up of Credit Suisse in a matter of weeks. In addition, we are closer to the peak of the global interest rate cycle. Together, this makes ‘financial sector contagion’ seem more benign as a risk theme. However, the risk remains among the top risks for the quarter, albeit with a lower likelihood. This is driven by the fact that although areas of uncomfortably high leverage may not be obvious currently, we are likely to remain in a phase of restrictive monetary policy for some time. The longer these dynamics hold, the greater the chances that new pockets of stress among households, corporates, or governments will begin to appear.

Finally, the U.S. debt ceiling risk theme has edged out of our top risks as the two main political parties pulled together to avert the crisis. Though we will still likely see squabbling as details of spending cuts are worked out and implemented, the risk of a full-scale government shutdown or U.S. government default is not a relevant consideration for the time being.

GEOPOLITICS: MANAGING DIVISIONS IN A MULTI-POLAR WORLD

The conflict between Russia and Ukraine is still ongoing and the risks related to an escalation remain high. Ukraine has suffered severe losses to physical infrastructure as the war is being fought on its territory, while Russia has faced severe strategic setbacks – from an expanded NATO to a broad range of sanctions and a seemingly permanent loss of an energy market close to home (the EU).

The political coup in Niger and the ongoing conflict in Sudan are a reminder of the fragility of political and social stability in a region that has attracted renewed interest for its resources in the wake of the Russia-Ukraine conflict. For emerging markets such a Thailand, Turkey, and Argentina, elections and the course of current political events could drastically alter the policy trajectory.

Meanwhile, U.S.–China competition continues to play out, and in some areas continues to ramp up, despite recent high-level meetings. Businesses and countries – across Asia, Latin America, and the Middle East – are finding themselves caught in the middle of this geopolitical tussle.

In the post-pandemic world, geopolitics is also a key driver of new and emerging risks to supply chain resilience, climate, energy, and industrial policies, and of cyber vulnerabilities. We are monitoring the following risk themes related to geopolitics:

1. U.S.–China Competition: Despite recent diplomatic overtures, the U.S.-led technology decoupling continues to accelerate, with the country ramping up its efforts through tighter controls on supply of high-end chips, with other countries (such as the Netherlands, Japan, and even South Korea) getting drawn in as well. More legislation and a series of secondary sanctions and countersanctions are likely to continue. For businesses, a lack of cooperation in trade and climate matters, and non-tariff controls, would increase operational/continuity risks and compliance costs. Meanwhile, attempts at maintaining and reinforcing maneuverability in the seas could prompt larger and longer military drills in the Asia-Pacific region. A lack of cooperation over North Korea's renewed missile program could fuel an arms race in the region, with countries such as South Korea, Australia, and Japan boosting their security capabilities. As Mainland China indicated a willingness to escalate the ‘chip war’ with targeted retaliations, the GBI score for this theme remains the highest among our top risks for Q3 2023, at 51 (the score ranges between 1-100; a higher score indicates a higher global impact).

2. Russia–Ukraine Conflict Escalation:Well over a year past the outbreak of the conflict, battle lines remain frozen in a war that no one is winning. With diplomatic backsliding, such as on the Black Sea Grain Initiative, mounting economic pain, and Ukraine’s own counteroffensive with much bolder objectives, the conflict now seems to be moving in a direction that could require a heightened use of hard power. In addition, on more than one occasion, attacks inside Russian territory have been attributed to Ukraine – this could be used as grounds for an escalation. Any sort of escalation poses the risk of the use of more destructive weapons (e.g., tactical nuclear weapons) or a military accident pulling a NATO member directly into the conflict. We continue to assign a GBI score of 48 to this risk scenario.

3. Supply Chain Difficulties: With Covid-linked disruptions on goods supplies in the rear-view mirror, supply chain normalization lies ahead. However, newer challenges, from natural disasters to large-scale systemic failures, sanctions, and export controls emanating from geopolitical considerations, remain a risk. In the near term, we are watching risks arising from countries trying to secure supply chains of critical raw materials that are essential in high-tech sectors such as electric car batteries. Mainland China’s export controls on germanium and gallium entered into force on Aug 1, 2023, becoming the latest move in geopolitically motivated restrictions and resource nationalization. Businesses could be forced towards costly reorientation to countries that have a controlling stake in these supplies. The GBI score for the risk theme has moved up marginally, to 30.

4. Political Instability in Developing Markets: Political instability is somewhat inherent in frontier markets such as Niger, which in July became the latest country in Africa to witness a coup, and Sudan, which remains marred by internal conflict. Concurrent political events in emerging markets remain a risk to financial flows: in Thailand, surprisingly strong support for a reformist political party in the May 2023 elections has given way to a stalemate over government formation. Given the country’s recent political history, a perception that the military-aligned ruling establishment is undermining a popular mandate could trigger mass protests, which could even turn violent. At the same time, although Turkey’s elections returned the incumbent government to power, this has been accompanied by a U-turn on economic policymaking and, to some extent, on foreign policy – though markets remain unconvinced by this seemingly positive change. Finally, the August primaries in Argentina could produce a surprise. Taken together, these events highlight a wide range of risk scenarios associated with political and policy instability in developing markets, which could trigger a selloff in financial markets. We assess the GBI risk for this theme to have marginally increased to 30, up from 27 in Q2 2023.

5. Climate Policies: Europe’s energy insecurity has globally sped up the process of energy transition for countries that have resources. On the other hand, highly vulnerable countries will be forced to prioritize keeping the lights on, using stop-gap arrangements such as coal. Increasingly, countries will fall into one of two groups: those that disregard or have reversed progress on climate targets and those that have accelerated towards them. While governments figure out priorities, businesses will continue to suffer uncertainty. With the EU’s steps towards imposing carbon taxes and the U.S. push to provide green subsidies under the Inflation Reduction Act, we expect trade fragmentation based on policy differentials, and for topics such as environmental impact, energy mix and carbon reduction to become recurrent features in board room discussions. We continue to assign a GBI score of 27 (the same as in Q2 2023) to the risks related to changes in climate action policies.

6. Cyber Vulnerabilities: Cyberspace is a lower-cost and convenient battle ground for nation-states at war with each other, and private companies can often become collateral damage. As geopolitical tensions soar, so do the threat levels in cyberspace. It is also noteworthy that the pace of digitalization during the pandemic far outstripped the pace of upgrading organizations’ cybersecurity capabilities. Also, under sanctions, many businesses are shut out from access to critical technologies, which makes intellectual property theft a matter of strategic importance. We continue to assess the GBI score for this risk scenario to be at 22.

7. Politics in the EU: The rioting in France in early July, the collapse of the Dutch government days later, and a snap election in Spain have set the stage for next year’s European Parliament elections. As they draw near, the bloc’s cohesion will begin to be tested again. Migration and asylum could emerge as deeply polarizing political issues across the continent. Added to this, as the pain of economic slowdown spreads, the bloc, which has so far held tightly together over dealings with Russia, could see widening differences over foreign and economic policies as nations chart their individual courses, especially on relations with China. The balance of risk could begin tilting away from European consolidation towards fragmentation, creating wide-ranging uncertainties for cross-border businesses. We assign a GBI score of 21 to this risk scenario.

WILL THE GLOBAL ECONOMY AVOID THE STAGFLATIONARY VORTEX?

The globally synchronized monetary tightening of the past year and a half has started to bear fruit, as inflation around the world is coming down. This progress on inflation seems more modest when core prices are taken into consideration, and factoring in the base effects of high inflation from last year (U.S. headline inflation peaked in Q2 2022). But for now, monetary policies seem to be delivering on their promise.

Most economies are at or near the peak of their interest rate cycles, and we are now nearing a juncture where monetary policy will begin to diverge, in accordance with the economic performance of individual economies. We got a glimpse of this divergence before the end of Q2 2023. Central banks, such as those of Canada and Australia, resumed the path of rate hikes after pausing monetary tightening; the Bank of England stepped up its rate hike; the European Central Bank persisted with its incremental hikes; the People’s Bank of China cut several of its key interest rates; the Bank of Japan retained its short-term rates in negative territory; and the U.S. Fed skipped a rate change in June before delivering an expected hike in July.

With the unprecedented level of monetary tightening, an economic slowdown is a given. And with effects of monetary tightening appearing with a lag, global growth may also find itself credit-bound. Supply side shocks to food or energy, triggered by weather-related events or geopolitics, could unleash the demons of inflation once again, threatening to derail this glide past the stagflationary (low growth and high inflation) vortex. All things considered, the risks to global growth in Q3 2023 seem less intimidating than they were at the start of Q2 2023. We are monitoring the following related risk themes:

8. Slide Towards Stagflation: A credit freeze from monetary policy tightening could trigger a visible slowdown in the U.S., the eurozone, and the UK. Exports to these markets will slump, triggering a second order slowdown in trading partners in Asia, Europe, and Latin America. Meanwhile, core inflation could continue to remain sticky and headline inflation, while coming down, could stay well above target. Central banks will be forced into a freeze, as further tightening would be unwarranted, but rate cuts would be hard to justify given inflation dynamics. Large economies may tip into recession at different points during the year and the global economy may experience a period of sluggish growth and elevated inflation. This risk has a high GBI score of 36 in Q3 2023, lower than the GBI score of 47 in Q2 2023.

9. Social Instability: Cost-of-living issues remain front and center for populations that have suffered from the pandemic and now face poor economic prospects. Sustained high food prices, coupled with extreme climate events such as successive periods of drought in Africa, parts of Europe and Latin America, or flooding in the Asia-Pacific region, could create acute food insecurity. Extreme weather events are more likely in Q3 2023 due to the El Nino effect. Separately, Russia’s decision to pull out of the Black Sea Grain Initiative could also reverse the gains on cooling agricultural commodity prices. As public balance sheets remain stretched from the rising cost of debt, the ripple effects of a slowdown in global trade and rising food prices will be felt more sharply, especially among developing markets, creating the conditions in which spontaneous street protests could break out. This risk, with a GBI score of 26, remains one to watch.

10. Financial Sector Contagion: The dramatic fall of Silicon Valley Bank (SVB), a midsized U.S. bank, on March 10, 2023, triggered a series of events that wiped off billions of dollars in stock and bond investments. Two months and three bank failures later, the bleed on U.S. regional bank stocks continued. Although authorities on both sides of the Atlantic stepped in with big, decisive moves to limit the spillover, depositor and investor unease still lingers, and results and news are being closely parsed. The announced merger of Bank of California and PacWest Bancorp in July indicates ongoing consolidation in the sector. Any sign of trouble at another bank could trigger panic among financial market agents across the globe – a glimpse of what was in seen in the fall of Credit Suisse within days of SVB’s failure. The GBI score for this risk is assessed as 14, below the GBI score of 30 in Q2 2023, on the back of lower probability and impact, as larger banks seem to be steering clear of trouble.

WHAT THIS MEANS FOR BUSINESSES

Dun & Bradstreet’s GBI score for Q3 2023 shows that the risks confronting businesses remain elevated. Some risk scenarios have worsened or stayed at the same level, while some new risks have appeared on our radar. Businesses and governments must navigate a tight credit environment, geopolitical competition, conflict, and political instability. They must also mitigate the impact of these factors on business activity, sovereign and business finances, and societal tensions. In this light, it is clear to see how unexpected events can suddenly worsen the risk environment for businesses operating cross-border.

The Q3 2023 GBRR analysis highlights that business decision-makers need to have contingency plans in place for the sudden disruption of seemingly secure supply chains, and increased awareness of the global economic environment and geopolitical developments. The geographical spread and diversity of the impact of our top 10 risks underline the importance of taking a broad approach to mitigating these risks.

TOP 10 POTENTIAL RISKS

| Ranking | Potential Risk | Potential Risk Scenario | Likelihood of Event (%) | Global Impact (1-5) | Global Business Impact Score (1-100) |

|---|---|---|---|---|---|

| 1 | U.S.–China competition | The U.S.-led technology decoupling effort continues to accelerate, with other countries getting drawn in. Mutually hostile legislation and sanctions and countersanctions continue to be rolled out. Mainland China escalates the ongoing ‘chip war’ with targeted retaliations. For businesses, other than non-tariff controls, lack of cooperation in trade and climate matters increases operational/continuity risks and compliance costs. Meanwhile, attempts to maintain and reinforce maneuverability in the seas prompt larger and longer military drills in the Asia-Pacific region. A lack of cooperation over North Korea's missile program fuels an arms race in the region. | 60 | 4.25 | 51 |

| 2 | Russia–Ukraine conflict escalation | Ukraine's counteroffensive miscalculates its position or strength; an attack on Russian territory allows Moscow to apportion blame more widely and respond with greater force. With reduced leverage on energy prices, and a breakdown in diplomacy, sharp military escalations follow. Western aid to Ukraine slows and Russia ramps up its targeting of high-profile civilian infrastructure to psychologically wear down the Ukrainian population, with a risk that tactical nuclear weapons are used, or a military accident pulls a NATO member directly into the conflict. | 60 | 4 | 48 |

| 3 | Slide towards stagflation | A credit freeze from monetary policy tightening triggers a visible slowdown in developed markets. Exports to these markets slump, triggering a second order slowdown in trading partners in Asia, Europe, and Latin America. Meanwhile, core inflation continues to remain sticky and headline inflation, while coming down, remains above target. Central banks are forced into a freeze, as further tightening is unwarranted, but rate cuts are hard to justify given inflation dynamics. Large economies tip into recession and the global economy is pushed towards a long period of sluggish growth and high inflation. | 45 | 4 | 36 |

| 4 | Supply chain difficulties | Securing scarce raw materials associated with delivering growth in high-tech industries, such as minerals critical in the green transition (e.g., manufacturing of electric vehicle batteries), the digital/tech industry, aerospace, and defense, becomes the new source of strain for supply chains. UK and EU legislation to secure supplies of critical raw materials kick off a geopolitical competition that requires companies to make costly choices. | 50 | 3 | 30 |

| 5 | Political instability in developing markets | In Thailand, the stalemate over government formation since the surprise May 2023 elections leads to judicial rulings, followed by street protests, which eventually turn violent. The ongoing violent conflict in Sudan and recent coup in Niger draw in other regional powers. Turkey’s renewed push to restore credibility to its policymaking with dramatic U-turns on monetary policy run into political challenges, spooking markets. Argentina’s primaries produce a surprise result. Together, these scenarios portend heightened political and policy instability among emerging markets, triggering a selloff in financial markets. | 50 | 3 | 30 |

| 6 | Climate policy | Europe's energy embargo on Russia changes global energy flows for good. Countries are split into two groups – one doubling down on fossil fuels and the other on renewables. Confusion over the direction of energy policy in Europe and Asia leaves businesses in the lurch on investment decisions, with some forced to make costly decisions on input energy mix. Differential trade treatment based on climate action becomes another cause of geopolitical strain, most recently visible in negotiations around green subsidies promised under the U.S. Inflation Reduction Act. | 45 | 3 | 27 |

| 7 | Social instability | Sustained high food prices, coupled with extreme climate events such as successive periods of drought in Africa or Latin America, or flooding in Asia due to El Nino effects, cause acute food insecurity among developing markets. Inflationary pressures resurface, and public balance sheets remain stretched from the rising cost of debt. The ripple effects of a slowdown in global trade growth are felt sharply, including by major commodity exporters, creating conditions for spontaneous street protests to break out. | 40 | 3.25 | 26 |

| 8 | Cyber vulnerabilities | Geopolitical scores are increasingly settled in cyberspace. Beyond governments, private businesses that serve critical national infrastructure are targeted. Increasing use of sanctions and export controls creates incentives to target intellectual property to advance national security and economic interests. As ransomware as a service (RaaS) picks up pace, smaller businesses realize that in the digitalization push from the pandemic, they have left gaping holes in their cybersecurity. | 55 | 2 | 22 |

| 9 | Politics in the EU | Rioting in France gives political parties across the EU, especially in countries where right-wing governments are in power, the opportunity to become more vocal on migration. Migration and asylum set the agenda for next year’s European Parliament elections. Simultaneously, economic malaise tests the bloc’s cohesion on foreign policy and energy choices, as countries begin to chart varying courses in their relations with Mainland China. | 35 | 3 | 21 |

| 10 | Financial sector contagion | Silicon Valley Bank’s dramatic fall triggered a series of events that wiped out billions in investor wealth. Although authorities stepped in with big, decisive moves to protect depositors, investor unease lingers. Months later, a trigger event – results, a scandal, audit findings or the revelation of a previously unknown exposure – brings back memories of this wipeout. Rumors of trouble at a large financial institution grips markets, panic ensues and spreads across borders, aided by social media, engulfing financial sector entities of European and Asian economies. Dominoes begin to fall, and growth takes a severe hit. | 20 | 3.75 | 15 |

*Total scores may have some rounding error

How Dun & Bradstreet Can Help

Dun & Bradstreet's Country Insight Solutions provide forecasts and business recommendations for 132 economies, allowing businesses to monitor and respond to economic commercial, and political risks To learn more, visit dnb.com/country-insight

ABOUT DUN & BRADSTREET*

Dun & Bradstreet, a leading global provider of B2B data, insights, and Al-driven platforms, helps organizations around the world grow and thrive. Dun & Bradstreet's Data Cloud fuels solutions and delivers insights that empower customers to grow revenue, increase margins, manage risk, and help stay compliant - even in changing times. Since 1841, companies of every size have relied on Dun & Bradstreet. Dun & Bradstreet is publicly traded on the New York Stock Exchange (NYSE: DNB). Twitter: @DunBradstreet