Global Business Optimism Insights Introduction

Dun & Bradstreet’s Global Business Optimism Insights (GBOI), the inaugural edition, is a quarterly report that not only aims to gauge the optimism levels of businesses globally, but also provides a unique and comprehensive view into the thinking behind the operational and investment expectations of business leaders.

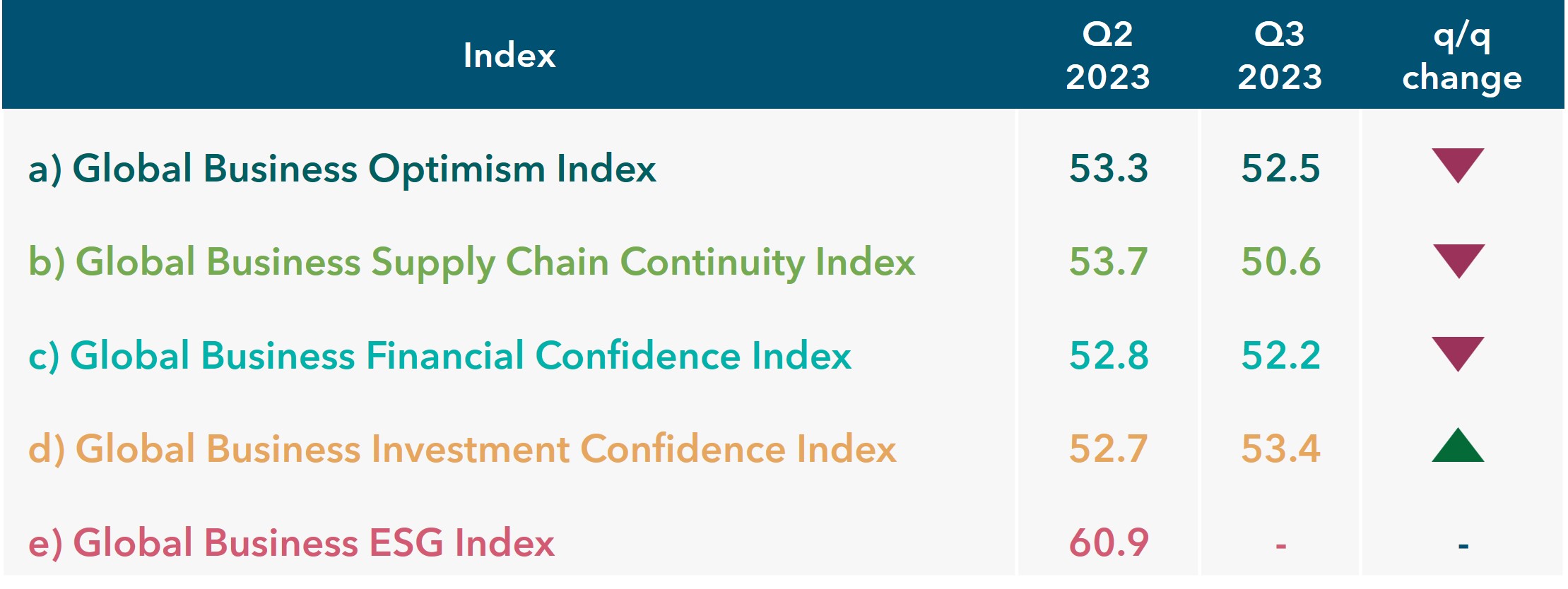

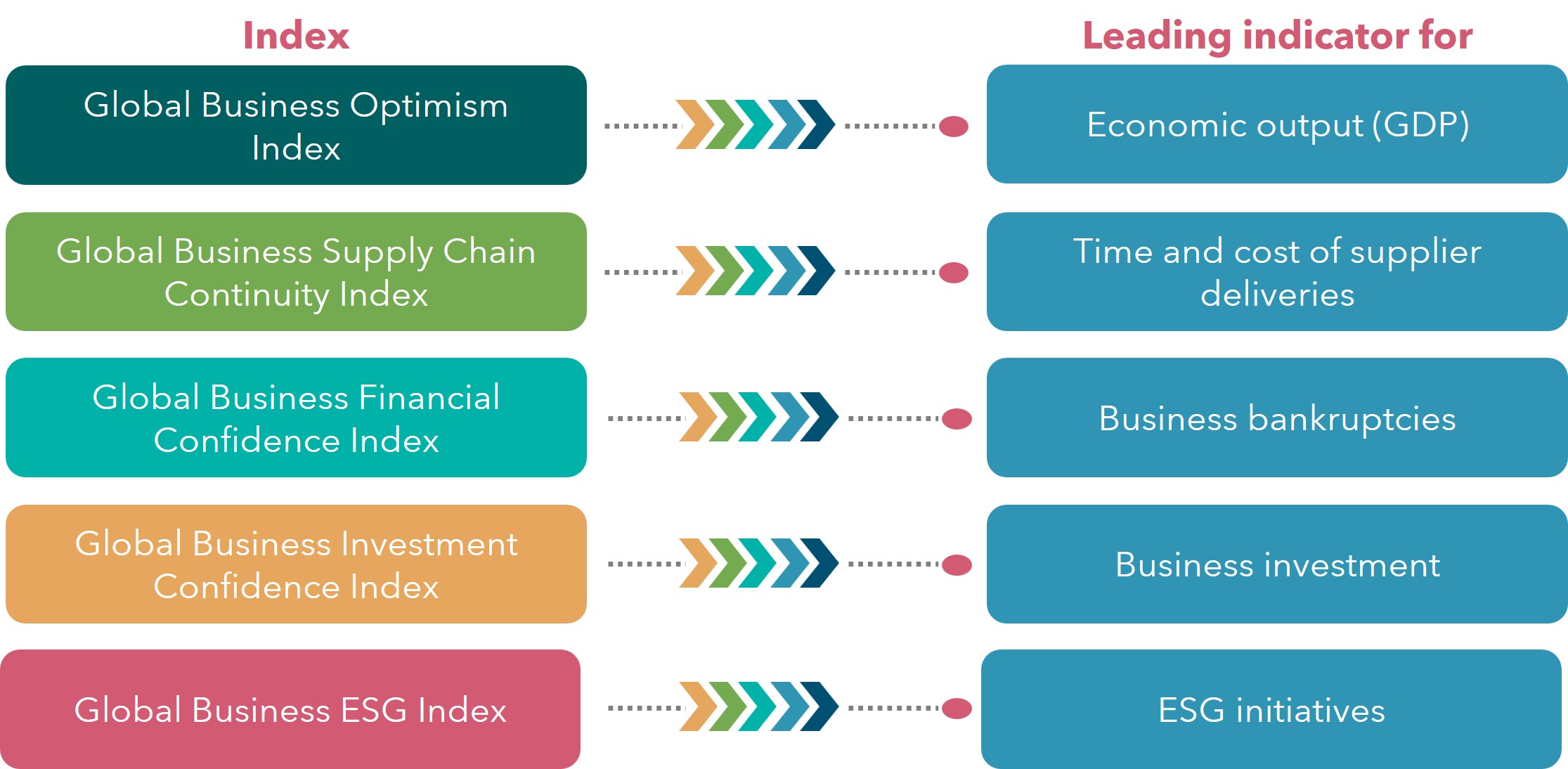

The GBOI is an amalgamation of 5 indices: Global Business Optimism Index, Global Business Supply Chain Continuity Index, Global Business Financial Confidence Index, Global Business Investment Confidence Index, and Global Business ESG Index. Apart from global-level indices, these five indices are also constructed for 32 economies, 17 sectors, and 3 business sizes. The indices range from 0 to 100, with a reading above 50 indicating an improvement and below 50 a deterioration (both compared with the same period in the previous year). The indices were created by synthesizing findings from a survey of approximately 10,000 businesses across 32 economies, along with insights from Dun & Bradstreet’s proprietary data and economic expertise.

THE INDICES

SUMMARY OF KEY FINDINGS

The Q3 2023 GBOI found that the global economy is expected to grow, though slower than it did in Q2 2023 due to the decline in advanced economies in contrast with the growth in emerging economies. A slowdown in the global economy and stress on corporate balance sheets have been brought about by the unprecedented monetary tightening, which assisted in controlling inflation in certain economies. However, the global economy has not fared as badly as expected, since most businesses expect a 2% to 6% expansion in their investment levels across technology, real estate, product development, and sustainability projects, providing hope for an improvement in economic conditions. The global economy will now enter a phase of greater policy divergence, as was witnessed when some key central banks chose different paths regarding interest rates. In addition, a key divergence that could emerge is between monetary and fiscal policy as governments try to protect jobs and livelihoods during the impending slowdown.

HEADLINE FINDINGS

- The Global Business Optimism Index declined 1.5% in Q3 2023, compared with Q2 2023; it declined 2% for advanced economies and grew 0.4% for emerging economies.

- The Global Business Supply Chain Continuity Index declined 5.8% in Q3 2023, compared with Q2 2023, indicating increased delivery time and cost as economic uncertainty and regulations now trump input costs as the top risks to supply chains.

- The Global Business Financial Confidence Index declined 1.3% in Q3 2023, compared with Q2 2023, due to continued stress on balance sheets and unprecedented monetary tightening.

- The Global Business Investment Confidence Index improved 1.4% in Q3 2023, compared with Q2 2023, as businesses expect productive slack to shrink this year, indicating optimism around investment recovery through 2023.

- The Global Business ESG Index for continental Europe lags the US and Asia due to differing energy security interests and approaches to renewable energy within the region.